In modern revenue management, rate shopping has long become a standard practice. Whether using tools like Lighthouse (formerly OTA Insight & HQ Revenue) or other providers, hotels rely on rate shoppers to monitor competitor prices, check parity, and assess their own market positioning.

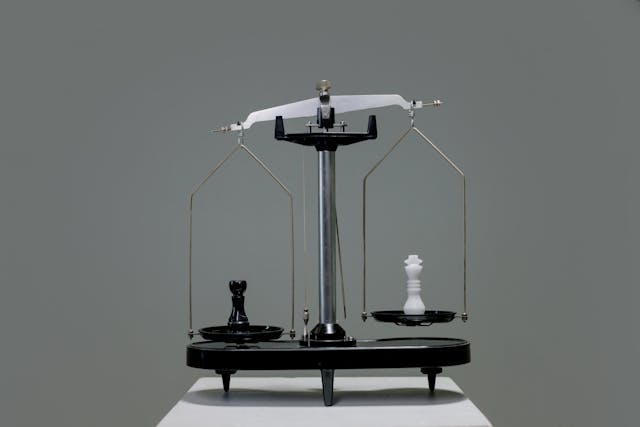

But the key question is: How can hotels ensure that price comparisons are truly meaningful?

What Does Rate Shopping Mean for Hotels?

Rate shopping is the systematic collection and analysis of hotel prices across different distribution channels. The goal is to create transparency and to better align pricing strategies with the market and competition.

For hotels, a professional tool like Lighthouse offers several advantages:

- Time savings – no more manual checking of websites and OTAs

- Market transparency – clear overview of competitor pricing

- Parity control – monitoring whether direct booking rates match OTA prices

- Data foundation for revenue management – informed pricing decisions instead of gut feeling

The Challenge: Prices Are Not Always Comparable

A rate shopper primarily delivers numbers – prices visible in the market at a given time, based on specific parameters.

The issue: These prices are often not directly comparable unless the underlying conditions are carefully defined.

Common pitfalls include:

- Room types: A “Standard” room in Hotel A is not the same as a “Standard” in Hotel B.

- Inclusions: Breakfast, parking, Wi-Fi – sometimes included, sometimes not.

- Rate types: BAR flex ≠ Non-Refundable.

- Channels: Direct booking vs. OTA with discounts or markups.

- Availability: Prices are dynamic – a snapshot is just a moment in time.

- Without the right setup, rate shopping can quickly lead hotels to draw the wrong conclusions and push themselves into a downward pricing spiral.

The Right Setup Makes the Difference

For rate shopping data from tools like Lighthouse to truly deliver value, a well-structured setup is crucial. Key factors include:

- 1. Competitor set: Select 6–8 hotels that are real alternatives for your target guests.

- 2. Room-type mapping: Compare standard to standard – not standard to superior or suite.

- 3. Rate mapping: BAR with BAR, Non-Refundable with Non-Refundable.

- 4. Distribution channels: Integrate your own website, OTAs, and metas correctly.

- 5. Search parameters: Define consistent occupancy (e.g., 2 adults), length of stay, and inclusions.

- 6. Parity: Set up alerts when OTAs undercut your direct website rate.

- 7. Data quality: Define frequency of rate checks and plan regular spot audits.

- 8. Internal alignment: Revenue, sales, and marketing must work together – data provides input, but decisions are made by the hotel.

Conclusion: Clean Setup = Better Decisions

Rate shopping is an essential tool to stay on top of a dynamic hotel market. But a rate shopper is not a set-and-forget solution.

Only with a clean setup and proper interpretation can the data become a reliable foundation for smart pricing decisions.

This way, hotels can unlock the full potential of their rate shopping strategy – and secure a real competitive advantage.